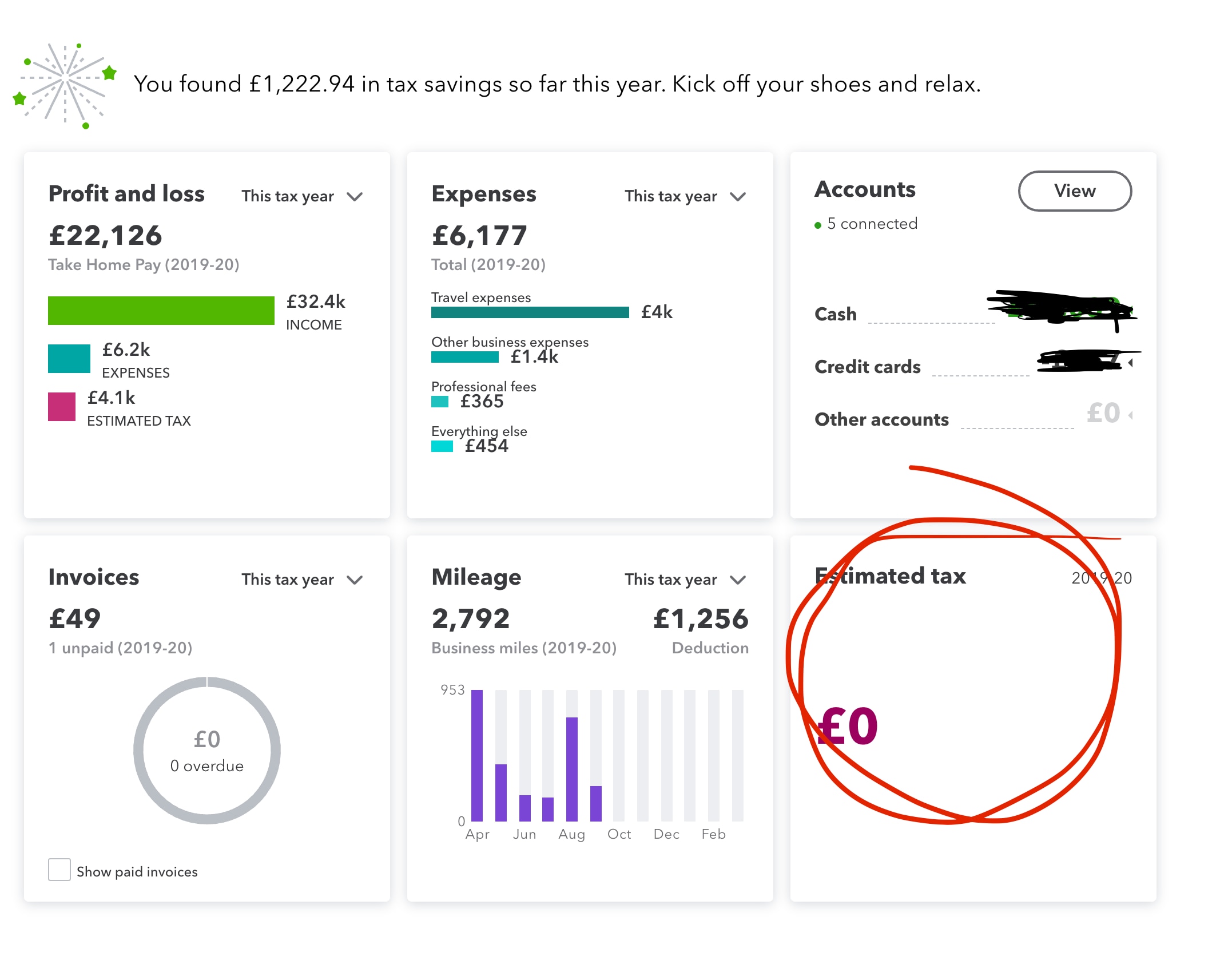

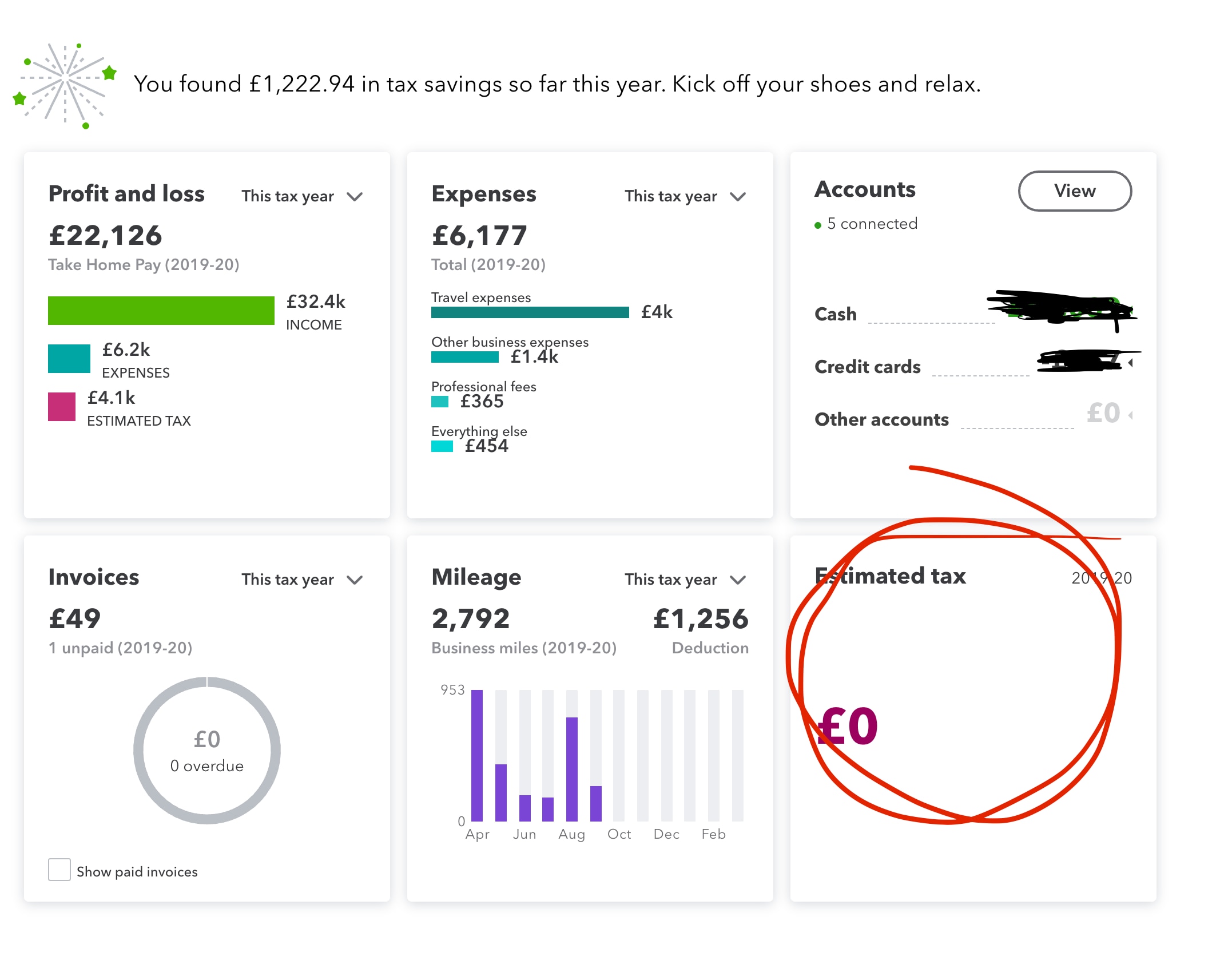

Helps uncover tax savings: Tax software will ask you questions you might not have thought of that could entitle you to credits or deductions, such as whether you had children or sold real estate in the previous year, says Robert Gauvreau, CPA and founder of Gauvreau & Associates. Offers instant insight: Riley Adams, CPA and founder of Young and the Invested, notes that tax software can instantly calculate how different filing decisions will affect your tax bill. Provides live support: While you won't see a tax professional in person if you use tax software, some programs provide live, one-on-one customer support over the internet or by phone.

Helps uncover tax savings: Tax software will ask you questions you might not have thought of that could entitle you to credits or deductions, such as whether you had children or sold real estate in the previous year, says Robert Gauvreau, CPA and founder of Gauvreau & Associates. Offers instant insight: Riley Adams, CPA and founder of Young and the Invested, notes that tax software can instantly calculate how different filing decisions will affect your tax bill. Provides live support: While you won't see a tax professional in person if you use tax software, some programs provide live, one-on-one customer support over the internet or by phone.

Cost-effective: You could easily pay a tax professional $220 or more to prepare an individual tax return, whereas using tax software will cost significantly less.Fast: Tax software can significantly speed up the filing process compared to doing your taxes manually with paper forms, especially if you've stayed organized throughout the year and have all your pertinent information readily available.

Easy to use: Most tax programs have intuitive interfaces that are easy to use, even if your knowledge of taxes and computers is minimal.

0 kommentar(er)

0 kommentar(er)